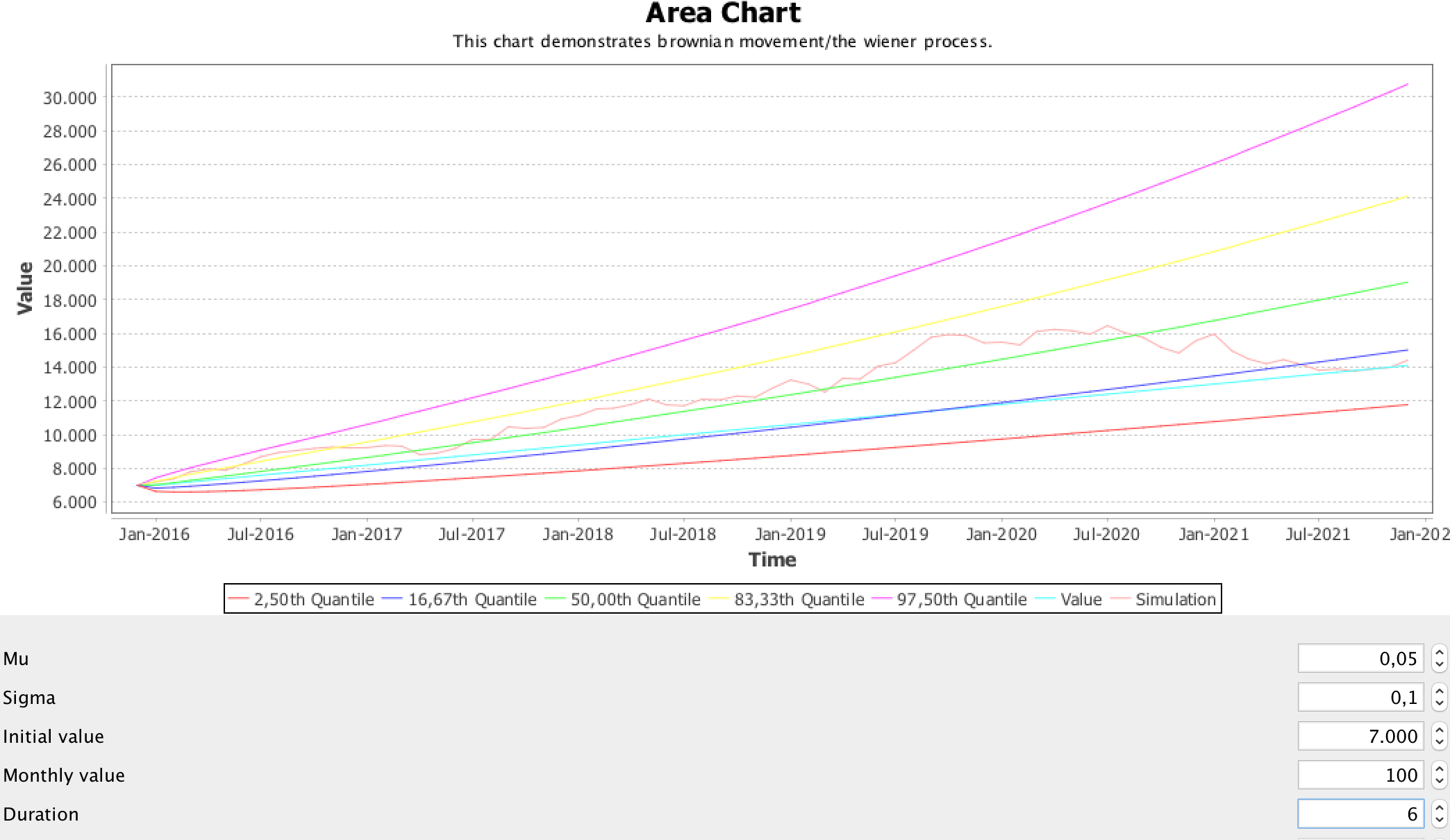

The Wiener process is a continuous-time stochastic process named in honor of Norbert Wiener. It’s commonly used to represent noise or financial development with a random component.

The geometric brownian motion can be calculated to visualize certain bounds (in quantiles) to hint about the absolute range.

For calculation following parameters are required:

- µ (mu): mean percentage

- σ (sigma): variance

- t: time period

- v: Initial value

The extension to the regular calculation uses:

m: Value increase per time period (in my case monthly value)

breaks: Quantile breaks to calculate the bounds

Code to calculate the values:

Applying the values:

- mu: 0.05 (or 5%)

- sigma: 0.1 (or 10%)

- initial value: 7000

- monthly increase: 100

- time period: 6 years

results in the following chart:

The code is available from Github. It ships with a Swing GUI to enter values and to draw a chart based on the calculation. https://gist.github.com/mp911de/464c1e0e2d19dfc904a7

Related information